Montenegro is becoming increasingly popular year after year. More and more tourists and foreign investors are buying properties, which has led to local property price increases. Particularly coastal areas such as Budva and Kotor are becoming a hub for tourism and luxury projects. This article provides dedicated information on the property rights of foreign citizens in Montenegro real estate investments, and other benefits as regulated by the Montenegrin Government.

Real Estate Market Overview

Montenegro is well-known for its strategic location, especially the coastal area, which attracts many tourists and investors every year who want to buy or invest in real estate in this country. Over the last few years, property prices have increased in Montenegro, which is due primarily to tourism and interest shown by international parties.

Mortgage interest rates are now running at about 5% to 6% and while loans are available, only a few banks offer loans for foreigners. In general, all areas have increasing prices, but especially coastal areas, like Budva and Kotor which are experiencing higher rates.

Which Areas Are Shaping the Future of Real Estate in Montenegro?

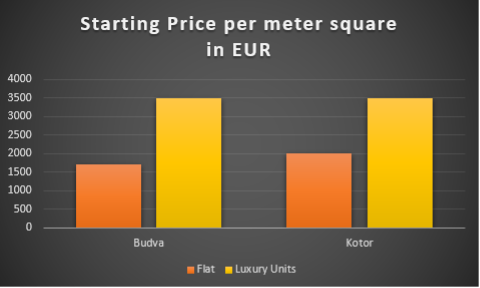

Budva: Montenegro’s prime seaside resort, Budva, had the highest real estate prices in the country. Flat prices range from €1,700 to €3,500/m², while luxury units reach €3,500 to €6,000/m². Villas can go up to €10,000/m². Budva benefits from strong tourism, with over 500,000 visitors annually, and a thriving short-term rental market (average rent around €1,370/month).

Infrastructure investment is increasing, including the approval of a €237 million Budva bypass (9 km of bridges and tunnels) in 2025. This project is expected to ease traffic and stimulate development nearby. New high-end residential complexes and luxury hotels are also underway. Analysts widely view Budva as a top investment hotspot for 2025.

Bay of Kotor (Kotor/Tivat area): Classified as a UNESCO World Heritage site, this destination is now a premium tourism location. In terms of flat prices, they range between €2,000 and €3,500/m², luxury apartments €3,500 and €8,000/m², and villas from €4,000 and €7,000/m². Additionally, we see that large projects like Porto Montenegro, Portonovi, and Luštica Bay are continuing to drive the market.

The region’s appeal is improved by cruise and yachting tourism and strong interest from foreign buyers. Since there’s not much land available and many luxury projects are still being built, property prices in Kotor are likely to stay high, just like in other coastal areas.

Can Foreigners Buy Property in Montenegro? Here’s What You Need to Know

Foreigners can purchase apartments, houses, and commercial property in Montenegro the same as citizens also with a few exceptions. These include:

- Agricultural land, forests, and border-zone properties (not available for foreign ownership)

- Cultural monuments

- Limited farmland (up to 5,000 m²), but only if purchased together with a residential property

All purchases must be formalized through a notarized sales contract and registered with the cadastral registry. Montenegro’s Constitution guarantees broad ownership rights to all individuals.

Taxes on Property in Montenegro: Rates, Rules, and What to Expect

Property Tax

Companies that own or use property in Montenegro must pay annual property tax, between 0.25% and 1% of the property’s value on January 1st.

If they buy a new property, they must report it within 30 days and file a yearly tax return.

The tax is paid in two installments, as decided by the tax office.

Property Transfer Tax

When buying property in Montenegro, buyers must pay a transfer tax of 3% to 6%, based on the property’s market value.

The buyer must calculate the tax, submit a tax return, and pay it within 15 days of signing the contract or acquiring the property.

Other tax considerations:

Tax Type | Rate |

Personal Income Tax | 0%, 9%,15% |

Corporate Income Tax | 9%,12%,15% |

VAT | 21% |

Withholding Tax on Dividends (Non-residents) | 15% |

Withholding Tax on Interest (Non-residents) | 15% |

Withholding Tax on Royalties (Non-residents) | 15% |

To learn more about the taxation aspects and more about Montenegro, click here.

If you are interested in investing in Montenegro, it is advisable to consult with a professional on investment opportunities that best suit your needs. Our firm specializes in international taxation, and our team is ready to assist with any related matters. If needed, we can connect you with top professionals to support your business activities in Montenegro. Please feel free to contact us.