Albania, strategically located in Southeastern Europe’s Balkan Peninsula, is experiencing a notable rise in investments and tourism, making the country very favorable for real estate investments. Recognized for its affordability, Albania is one of Europe’s countries where living expenses, housing costs, and property prices are comparably less expensive when compared to any other European country. This article provides dedicated information on the property rights of foreign citizens in Albanian real estate investments, and other benefits as regulated by the Albanian Government.

Real Estate Market Overview

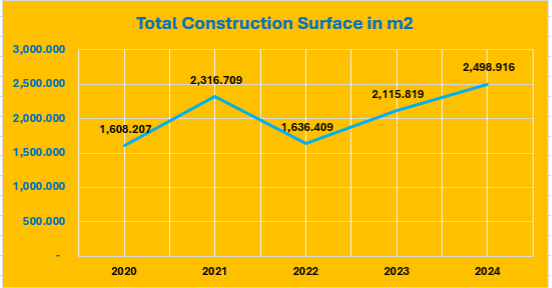

Albania is experiencing high levels of urbanization and currently, the construction industry is experiencing a booming effect, both in residential and commercial sectors. The construction projects are expanding in main cities such as the capital Tirana, and coastal ones including Vlora, Saranda, and Durres. For instance, according to the data published by the Institute of Statistics of Albania (INSTAT) between 2020 and 2024, over 6,600 permits for new buildings were issued, covering a total of approximately 10 million square meters of new construction. Moreover, the 2024 construction data indicates that in the fourth quarter of the year, the volume of new construction (measured in square meters) increased by approximately 35%.

While several factors affluence the growth of the construction industry in Albania, mainly increased foreign investments, government-backed urban development initiatives, and the growing economy, have been the key drivers in the rapid urbanization of the country.

Which Areas Are Shaping the Future of Real Estate in Albania?

Tirana. The capital of Albania, Tirana has attracted several exciting construction projects nationwide. In 2024, Tirana accounted for 77% of all new construction activity nationwide. Construction projects include new residential buildings, shopping centers, office spaces, and major infrastructure improvements. New projects are now combining living, working, and shopping spaces in one place, following modern urban trends. The focus is on using modern designs, improving energy efficiency, and making the city more connected and livable.

The most central areas include Blloku, Skanderbeg Square, Mother Theresa Square, Komuna e Parisit, and the Artificial Lake area. These neighborhoods each have their exceptional character and draw different types of residents, which as well, notably, have a high demand for rentals. Notwithstanding, the construction projects are now expanding to other areas, in the suburban parts of the city, or those near the Dajti mountain.

Vlora. Located in the southern part of Albania, home to the beautiful Ionian Sea, it is a beautiful coastal city along the renowned Albanian Riviera, celebrated for its stunning beaches and rich Mediterranean culture. Vlora ranks as the third-largest city for new construction, hosting some of the most prestigious and luxurious projects in the country. For instance, in 2024 alone, the total volume of new construction reached approximately 90,000 square meters.

Can Foreigners Buy Property in Albania? Here’s What You Need to Know

Foreigners possess equal rights to purchase property in Albania as locals, whether it’s in the capital or along the coast. Foreign individuals or entities engaging in or having undertaken investments in the Republic of Albania are entitled to acquire land upon successful completion of the investment in compliance with the issued construction permit. This right is granted when the value of the acquired or constructed assets exceeds three times the initial value of the land.

The transfer of ownership rights for agricultural land, forests, meadows, and pastures is not entitled to foreign individuals and entities. However, they enjoy the privilege of leasing these properties for a period of up to 99 years. The above restriction does not apply if a new Albanian company is formed, whether it’s entirely owned by a foreign investor or established by purchasing shares in existing Albanian companies.

Taxes on Property in Albania: Rates, Rules, and What to Expect

Property Taxes

The real estate tax in Albania depends on the type of activity linked to the building and is based on its value. It is calculated annually at the following rates:

- Residential properties: 0.05% of the property’s value.

- Commercial properties: 0.2% of the property’s value.

- Construction sites where building deadlines (set by the construction permit) are missed: taxed at 30% of the above rates.

Inheritance and Gift Taxes

Inheritance and gifts are generally taxed at 15% of their value, with no deductions allowed. However, exemptions apply in these cases:

- Transfers between first- and second-degree legal heirs and between siblings.

- Gifts and inheritances of up to ALL 5 million for real estate and ALL 1 million for movable assets.

Transfers of ownership rights deriving from co-ownership based on Law No. 7501, dated 19 July 1991, “On Land,” as amended.

Other tax considerations:

Tax | Rate |

Personal Income Tax | 0% – 23% |

Corporate Income Tax | 15% |

VAT | 20% |

Withholding tax on dividends to non-residents | 8% |

Withholding tax on interest to non-residents | 15% |

Withholding tax on royalties to non-residents | 15% |

To learn more about the taxation aspects and more about Albania, click here.

The real estate sector in Albania is an ideal space for those who want to maximize income from real estate investments. Strategic geographical position, long seashores of the Adriatic and Ionian seas, proximity to major European cities access to short flights are features that make it exceptionally attractive.

If you are interested in investing in Albania, it is advisable to consult with a professional on investment opportunities that best suit your needs. Our firm specializes in international taxation, and our team is ready to assist with any related matters. If needed, we can connect you with top professionals to support your business activities in Albania. Please feel free to contact us.