Supporting Strategic Investments in Bosnia and Herzegovina: Incentive Policies Overview

Strategic investment incentives in Bosnia and Herzegovina aim to attract foreign and domestic investors through financial benefits in reliefs, providing regulatory support for various industries such as manufacturing, energy, information technology, tourism, and agriculture. These industries have the potential to encourage economic growth and job opening. The government of Bosnia and Herzegovina, hence, has developed a tax framework involving custom duties exemptions, reduced corporate income tax, and grants for capital investments in underdeveloped areas. This is further supported by Bosnia’s favorable trade agreements, skilled workforce, and proximity to the European Union.

Numbers to Look At

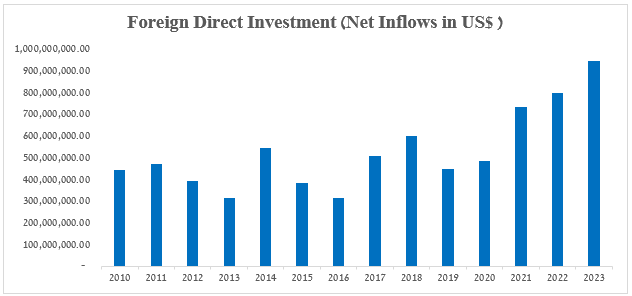

Bosnia and Herzegovina offers a liberal trade regime and boasts one of the lowest and most simplified tax structures in the region, with a 17 percent VAT and a 10 percent flat income tax. From 2010 to 2023, the country attracted approximately $7.38 billion in foreign direct investment (FDI), with Austria, Croatia, Serbia, Slovenia, and Germany ranking as the top investors. The following table provides a comparative overview of the FDIs in the last decade, in USD value:

Encouraging Investments in Bosnia and Herzegovina

The Law on the Policy of Foreign Direct Investments of Bosnia and Herzegovina ensures equal treatment for foreign investors, granting them the same rights and obligations as residents. It allows investors to open bank accounts in any commercial bank using domestic or convertible currencies and to hire foreign nationals, following local labor and immigration laws. Investors can freely transfer profits abroad without restrictions and own real estate with the same property rights as local entities. The law protects foreign investors from nationalization or expropriation, allowing such actions only in the public interest with prompt and fair compensation. Furthermore, investor rights cannot be overridden by future regulations, and if new laws offer more favorable conditions, investors can choose which legal framework will govern their investments.

The Foreign Investment Promotion Agency of Bosnia and Herzegovina (FIPA), an ad-hoc agency established to promote foreign investments in the country, serves as a bridge facilitating the connection between public and private sectors, providing customized and thorough information on the potential investment policies.

Free Trade Zones in Bosnia and Herzegovina

Free trade zones in Bosnia and Herzegovina are part of the customs territory, and at the same time, they are legal entities. According to the Law on Free Trade Zones, these may be founded by one or more domestic or foreign legal entities or individuals. Businesses within the zones have tax exemptions on VAT and import duties on equipment used for production.

Investment, profit repatriation, and the mobility of capital are free in the zones. The setting up of a Free trade zone is approved provided a feasibility study shows that at least 50% of the goods produced within the zone will be exported within 12 months.

To read more about taxation in Bosnia and Herzegovina, click here.

Tax Incentives for Foreign Investors in the Federation of Bosnia and Herzegovina

There are several incentives in the Federation of Bosnia and Herzegovina aimed at foreign investors. Under the Law on Corporate Income Tax, for instance, companies that invest over 50% of their annual profit in the purchase of equipment for production are allowed a 30% reduction in income tax in the year they made such an investment. In addition, every company that invests at least €10 million within five successive years, with a minimum investment of €2 million for the first year, receives a deduction of 50% of their income tax for the year such investment is made.

Employers may also deduct the doubling of gross wages for new employees if the employee agreement was for at least 12 months full-time and the employee has not worked for them or affiliated companies during the previous five years.

To read more about Bosnia and Herzegovina click here.

Tax Incentives for Investment in the Republic of Srpska

In the Republic of Srpska, several tax incentives are available to encourage investment. Companies that invest in property, plant, or equipment for registered manufacturing activities can reduce their tax base by the amount of the investment. Employees in the textile, clothing, and leather sectors earning below the previous year’s average gross salary benefit from a reduced contribution base, calculated as 25% of the average gross salary from the previous year. Additionally, the region has abolished the dividend tax and introduced favorable rules for taxing income from foreign sources. Qualified investors can also receive tax benefits on their annual income under specific conditions.

If you are interested in investing in Bosnia and Herzegovina, it is advisable to consult with a professional on investment opportunities that best suit your needs. Our firm specializes in international taxation, and our team is ready to assist with any related matters. If needed, we can connect you with top professionals to support your business activities in Bosnia and Herzegovina. Please feel free to contact us.