Personal Income Tax in the Western Balkans: Comparing Albania, Kosovo and Montenegro Tax Policies

Personal Income Tax (hereinafter referred to as PIT) is a tax that governments impose on individuals’ incomes, which include wages, salaries, and all other types of income generated from investments and other sources. Tax rates vary by country and reflect each nation’s unique economic and financial policies.

This article aims to provide an overview of personal income taxation in several Western Balkan countries, specifically Albania, Kosovo, and Montenegro. It is designed to offer readers, including those considering relocation or investment, a comprehensive and insightful understanding of the personal income taxation and benefits available in each of these countries.

Overview of the Personal Income Taxation

Albania

The country uses a comprehensive approach to personal income tax, designed to address the tax obligations of both resident and non-resident individuals effectively. Resident individuals in the Republic of Albania are taxed on all income, regardless of where it is earned, both within and outside Albania. Non-resident individuals, however, are taxed only on income earned within Albania. Taxable income in Albania includes a variety of sources, including, but not limited to, wages and labor-related compensations, profits from corporate shares or partnerships, earnings from bank interests or bonds, revenues from copyright or intellectual property, and incomes derived from leases, loans, or similar agreements. Additional sources include income from real estate sales, gambling, and casinos, and profits from share or stock sales.

To learn more about taxation in Albania, click here.

Kosovo

The tax system in Kosovo is designed to be straightforward, aiming to cover a broad tax base and offer low taxes that attract foreign investors seeking tax advantages. Personal income taxation applies to several types of income, such as wages, rental income, earnings from intangible assets, specific interest types (like loans, savings accounts, and bonds), replacement income, capital gains, lottery winnings, and pensions. Employment income includes not just wages but also bonuses, per-diems, insurance premiums, debt forgiveness, payment of personal expenses by the employer, and benefits in kind over a certain threshold.

To learn more about taxation in Kosovo, click here.

Montenegro

The taxation of individual income in Montenegro depends on residency status. Residents are responsible for taxes on their global income from any source, while non-residents are taxed on income linked to a fixed base/permanent establishment in Montenegro. In Montenegro, there is an additional tax called a local surtax that you pay on top of your regular income tax. This surtax goes to the municipality where you live in Montenegro. Most municipalities charge a 13% surtax rate, but in Podgorica and Cetinje, it is set at 15%. The surtax amount is calculated based on your income tax.

To learn more about taxation in Montenegro, click here.

The following table provides a summarized comparable study on income taxation in Albania, Kosovo and Montenegro:

| Albania | Kosovo | Montenegro |

Tax Base for Residents | Residents pay tax on their worldwide income. | A resident individual is subject to tax on his or her Kosovo-source and foreign-source taxable income. | Residents are subject to tax on their worldwide income. |

Tax Base for Non-Residents | Nonresidents pay tax only on Albanian-sourced income. | A nonresident individual is subject to tax on his or her Kosovo-source taxable income. | Non-residents are subject to Montenegrin tax on income sourced in Montenegro. |

Income Sources | Income derived from employment is subject to a progressive rate structure, while other income is subject to tax at a flat rate (either by self-assessment or through withholding). | Taxable income for a tax period is the difference between (a) gross income received or accrued during the tax period; and (b) the deductions allowable under the LPIT with respect to such gross income. | Resident individuals are subject to tax on their worldwide income, including capital gain. |

Tax Rates | Click here to learn more about how PIT is levied in Albania. | Click here to learn more about how PIT is levied in Kosovo. | Click here to learn more about how PIT is levied in Montenegro. |

Personal Income Tax Rates

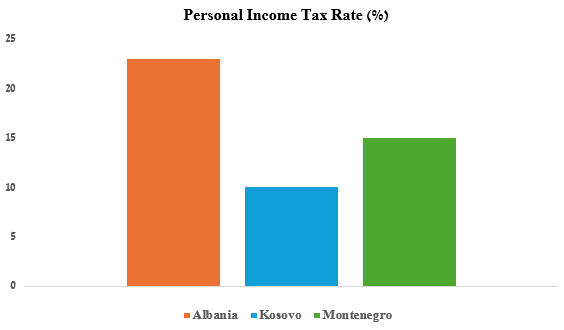

While the three countries share similarities in the regulation of personal taxation, they differ in certain aspects, such as tax rates. In Albania, personal income is taxed up to 23%, in Kosovo up to 10%, and in Montenegro up to 15%.

In the following graphic, a comparative view of taxation is presented for each of the countries:

Incentives and Exemptions

Albanian Legislator provides several tax exemption policies for the subjects. The following are some of the main exemption policies provided in Albania:

- Donations and inheritances received between legal heirs in the first and second degrees, as well as donations and inheritances between siblings.

- Donations and inheritances not covered under point (a) are exempt up to 5,000,000 ALL per taxpayer for immovable property and up to 1,000,000 ALL for movable property.

- The transfer of ownership rights to legal heirs, whether through donation or relinquishment, is exempt when the property originates from co-ownership.

To learn more about tax incentives in Albania, click here.

Kosovo Legislator provides several tax exemption policies for the subjects. The following are some of the main exemption policies provided in Kosovo:

- Wages of foreign diplomats, consular representatives, and embassy staff; wages of employees in international governmental and non-governmental organizations registered in Kosovo; wages of foreign workers in donor agencies, humanitarian aid providers, KFOR, and EULEX;

- Compensation for property damage;

- Life insurance payouts after death; wages of individuals with special needs as per relevant laws;

- Rewards for achievements in science, sports, and culture; and income from grants, subsidies, and donations earned under specific conditions.

To learn more about tax incentives in Kosovo, click here.

Montenegro Legislator provides several tax exemption policies for the subjects. The following are some of the main exemption policies provided in Montenegro:

- A self-employed individual starting a business in an underdeveloped region is exempt from taxes for eight years from the date of establishment. However, this tax exemption is limited to EUR 200,000 over the eight years.

- Certain compensation receipts are not subject to taxation, such as daily allowances, severance payments, scholarships, compensations for damages, jubilee awards, etc.

To learn more about tax incentives in Montenegro, click here.

Why Consider Western Balkan Countries?

Each of these Balkan countries has its own distinct economic and financial system, contributing to a growing business environment. To attract investments, they offer different investment incentives, benefits, and regulatory advantages for both local and foreign investors. Kosovo has relatively lower personal income tax rates compared to neighboring countries, making it a more attractive destination for individuals and businesses seeking favorable tax conditions.

On the other hand, Albania’s strategic location and legal and administrative reforms have been key factors driving significant transformations in its business in recent years. Its proximity to major European markets, coupled with economic reforms, has attracted a growing number of foreign investors and expatriates. Many are choosing Albania not only for its advantageous geographic position but also for its favorable business environment conditions, including a low tax rate, diverse investment opportunities across various sectors, and a streamlined process for obtaining residence permits. These factors have made Albania an increasingly appealing destination for those looking to live and invest in a dynamic, evolving market.

Montenegro offers low personal income tax rates, as highlighted above. Similar to Kosovo and Albania, Montenegro is actively working towards improving its investment climate and encouraging a favorable environment for business growth. The country is making steady progress in enhancing its economic policies and infrastructure, aiming to attract foreign investments and drive sustainable development.

If you are considering Albania, Kosovo, or Montenegro to live and/or conduct your business, it is advisable to consult with a professional on investment opportunities that best suit your needs. Our firm specializes in international taxation, and our team is ready to assist with any related matters. If needed, we can connect you with top professionals to support your business activities in Albania. Please feel free to contact us.