Corporate Income Tax in the Western Balkans: Comparing Albania, Kosovo and Montenegro Tax Policies

Corporate Income Tax (hereinafter referred to as CIT) is a tax on the profits that businesses earn. It’s based on a company’s taxable income, calculated by subtracting expenses (like salaries, rent, and other operating costs) from total revenue. This profit is then taxed at rates set by each country or region. Tax rates and rules vary widely, with some countries offering different rates or incentives for certain industries or locations. Corporate income tax helps fund government services and ensures that businesses contribute to public revenue, similar to how individuals pay income tax.

This article aims to provide an overview of corporate income taxation in the Western Balkan region, specifically comparing Albania, Kosovo, and Montenegro. It is designed to offer readers, including those considering investing, a comprehensive and insightful understanding of the corporate income taxation and benefits available in each of these countries.

Overview of the Corporate Income Taxation

Albania

Albania’s corporate income tax system, with a base rate of 15% on profits after allowable expense deductions, makes it a competitive investment destination in Europe. The tax applies to various entities, including collective societies, limited partnerships, limited liability companies, joint stock companies, and other entities, including non-residents. A company is tax-resident if established or managed in Albania, especially if board meetings are held there or specific local criteria are met, such as local ownership or resident board members. A Permanent Establishment includes any fixed business location or service provision in Albania for six months or more.

To learn more about taxation in Albania, click here.

Kosovo

Kosovo’s corporate tax framework, characterized by low tax rates, is designed to attract investment. Corporate tax residency applies to entities with their main office or effective management in Kosovo, with a 10% corporate income tax rate. A Permanent Establishment is created if a business has a fixed location in Kosovo for more than six months within a 12-month period, including offices, factories, or natural resource sites. Kosovo follows worldwide taxation, taxing residents on both foreign and domestic income, while non-residents are taxed only on income generated within Kosovo. Taxable entities include corporations, public/state-owned businesses, and non-residents with a Permanent Establishment in Kosovo.

To learn more about taxation in Kosovo, click here.

Montenegro

Montenegro, an attractive investment hub with a low corporate income tax rate of 9-15%, has streamlined its tax framework to meet EU standards, including recent amendments aligning with the EU’s Directive 2009/133/EC. Corporate tax residency is based on business establishment and profit generation within the country, with taxes filed annually by March. Taxable income includes profits from regular operations, property transfers, dividends, interest, and royalties. New changes affect CIT base calculations, capital gains valuation, and withholding tax expansion. Non-residents may benefit from reduced withholding tax on dividends, interest, and royalties through double-taxation treaties.

To learn more about taxation in Montenegro, click here.

The following table provides a summarized comparable study on income taxation in Albania, Kosovo and Montenegro:

| Albania | Kosovo | Montenegro |

Tax Base for Residents | A resident company pays tax on their worldwide income. | A resident company in Kosovo is subject to corporate income tax on Kosovo-source and foreign-source income. | A resident company is taxed on its worldwide income. |

Tax Base for Non-Residents | The income tax base for nonresident corporations is Albanian-sourced income. | A non-resident company in Kosovo is subject to corporate income tax on Kosovo-source income. | Nonresident companies are taxed on their Montenegrin source income. |

Taxable Profit | Taxable profit for Albanian corporate tax purposes is based on income as reported in the corporation’s financial statements (prepared in accordance with accounting regulations), taking into account deductions and corrections required by the tax laws. | In Kosovo, corporate income tax is generally measured by net profit, which is the difference between the gross income received or generated and allowable deducted expenses. | The taxable base is determined from the company’s profit and loss statement, and generally, business expenses are deductible if they are aimed at earning or maintaining taxable income, directly related to the business activity, are incurred or accrued during the taxable period, and are properly documented. Deductible operating expenses typically include the normal day-to-day costs of running the business. |

Taxation Rates

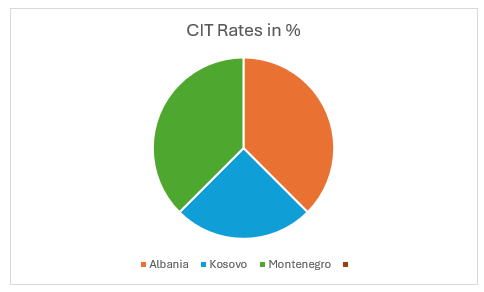

While the three countries share similarities in the regulation of corporate taxation, they differ in certain aspects, such as tax rates. In Albania, business income is taxed at 15%, in Kosovo at 10%, and in Montenegro CIT is levied progressively, ranging from 9 percent to 15 percent.

In the following graphic, a comparative view of taxation is presented for each of the countries:

Incentives and Exemptions

Albanian Legislator exempts certain entities from corporate income tax, including government bodies, financial institutions like the Bank of Albania, and foundations or non-banking financial institutions that support government policies through loans. Additionally, organizations engaged in religious, humanitarian, charitable, scientific, or educational activities, as well as labor organizations and chambers of commerce, are exempt. Tax periods align with calendar years, requiring corporate income tax returns to be filed by March 31 of the following year. Corporations with annual turnover under 14 million Albanian lek (ALL) are exempt, while software production and agro-tourism companies benefit from a reduced tax rate of 5%.

To learn more about tax incentives in Albania, click here.

Kosovo Legislator offers a range of tax incentives and credits to stimulate economic activity and investment. Dividends for both residents and non-residents are exempt from taxation, allowing investors to keep more earnings. Companies investing in new heavy machinery receive a 10% deduction on corporate income tax for these assets, although this benefit does not apply to those already utilizing other tax incentives. The country promotes social development by providing corporate income tax credits of up to 30% for sports sponsorships and 20% for contributions to youth and culture. Additionally, Kosovo offers a foreign tax credit to mitigate double taxation on income earned abroad.

To learn more about tax incentives in Kosovo, click here.

Montenegro Legislator offers various corporate tax deductions, including tax depreciation, business-related interest, and bad debts over 365 days with legal action. Charitable donations are deductible up to 3.5% of revenue, and salary and termination bonuses are also deductible, though entertainment and membership fees have limitations. Tax losses can be carried forward for up to five years. Corporate tax incentives include an eight-year exemption for new production businesses in underdeveloped areas, with exceptions for certain sectors. NGOs can reduce their tax base by €4,000 if profits support their objectives. The country’s strategic location and Euro currency enhance its appeal for foreign investments.

To learn more about tax incentives in Montenegro, click here.

Why Consider Western Balkan Countries?

Investors can consider Albania, Kosovo, and Montenegro for establishing a business due to their favorable tax regimes and investment incentives. Albania offers a corporate income tax rate of 15% and exemptions for small businesses and certain sectors, along with tax-deductible operating expenses. Kosovo stands out with its zero taxation on dividends and a 10% deduction on new heavy machinery investments, alongside credits for cultural contributions, making it attractive for socially responsible investors. Montenegro features one of Europe’s lowest tax rates at 9%, with additional incentives for new production businesses in underdeveloped areas and reduced rates for agriculture and software companies. Each country has unique exemptions and credits that support different sectors, making the region appealing for diverse investment strategies. The strategic locations of these countries, coupled with their efforts toward EU integration, enhance their potential as business hubs in Southeast Europe.

If you are considering Albania, Kosovo, or Montenegro to live and/or conduct your business, it is advisable to consult with a professional on investment opportunities that best suit your needs. Our firm specializes in international taxation, and our team is ready to assist with any related matters. If needed, we can connect you with top professionals to support your business activities in Albania. Please feel free to contact us.